in case anyone is interested in how they messed up the first deployed pool and why some money was "lost"

curve stableswapNG lets you define each coin with "asset types" which then decide how token prices are set (four different types). in the case of 4626 tokens, it uses the convertToAssets interface to get the actual underlying price (accurate conversion rate)

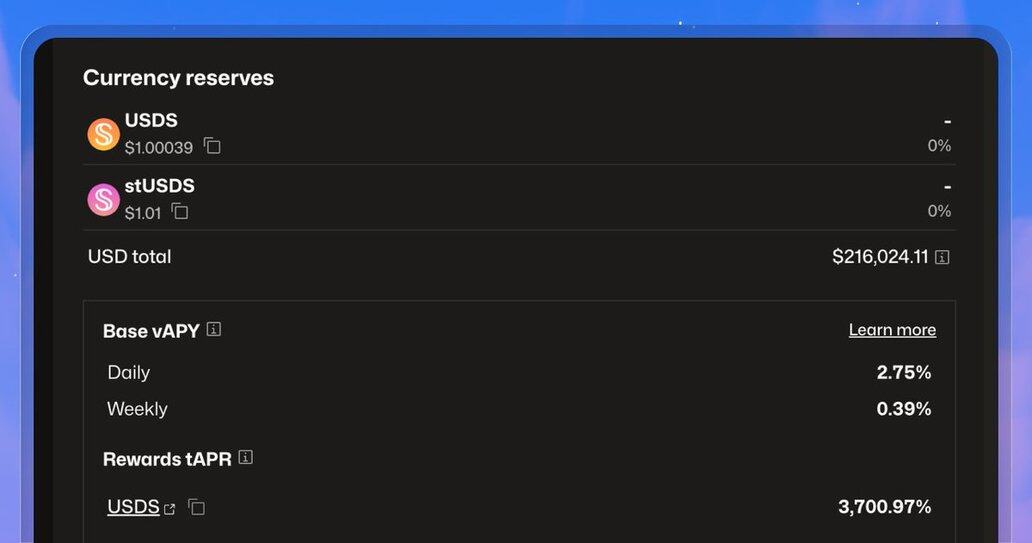

however sky deployed it with both assets as type 0, or just standard token. so the converted rate is 100 shares -> 101 USDS, but the pool will price it at 100. so then anyone can arb through this, and then the pool becomes very imbalanced (currently like 20:1).

adding to the problem is that the team already deposited 166k of rewards into the gauge, which has a 30-day epoch (locked) so thats why that pool technically still has an incentive going

A new USDS/stUSDS pool has been deployed on @CurveFinance with 500,000 USDS in incentives over three months for liquidity providers.

This new pool is designed to build supporting liquidity between USDS and stUSDS, functioning as the intended discount market for stUSDS.

The old sUSDS/stUSDS pool will provide boosted rewards on top of stUSDS.

New USDS/stUSDS pool (stUSDS discount market):

• Link:

• Address: 0x2C7C98A3b1582D83c43987202aEFf638312478aE

Old sUSDS/stUSDS pool (boosted rewards on stUSDS):

• Link:

• Address: 0xB0CEfaC820228827A3F40dEedBcA88D5De44bCa9

executing and understanding contracts in crypto is hard mang

3,140

15

本页面内容由第三方提供。除非另有说明,欧易不是所引用文章的作者,也不对此类材料主张任何版权。该内容仅供参考,并不代表欧易观点,不作为任何形式的认可,也不应被视为投资建议或购买或出售数字资产的招揽。在使用生成式人工智能提供摘要或其他信息的情况下,此类人工智能生成的内容可能不准确或不一致。请阅读链接文章,了解更多详情和信息。欧易不对第三方网站上的内容负责。包含稳定币、NFTs 等在内的数字资产涉及较高程度的风险,其价值可能会产生较大波动。请根据自身财务状况,仔细考虑交易或持有数字资产是否适合您。